Ensure safer credit approvals and transactions with seamless, frictionless identity verification. Real-time checks reduce fraud, validate customer information, and enable secure, trustworthy financial interactions while enhancing user experience and operational efficiency.

Explore Our Suite of Identity & Verification APIs for Modern Enterprises

Compliance First

Data Accuracy

APIs Hit success

Uptime

Learn why Veriqos is the right choice for you

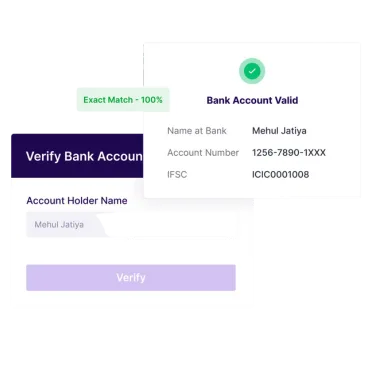

Real-Time Results

Get instant responses for every check — from ID verification to credit insights.

Built for Scale

Handle millions of verifications effortlessly with a scalable cloud infrastructure.

Plug-and-Play Integration

REST APIs and SDKs designed for rapid deployment with minimal effort.

Bank-Grade Security

End-to-end encryption, strict data privacy, and compliance with regulatory standards.

Compliance-Ready Architecture

Stay aligned with RBI, SEBI, IRDAI, and global KYC/AML mandates.

Smart Decisioning

AI-powered insights that go beyond raw data to help you make confident calls.

Real-Time Verification. Instant Compliance.

Onboarding Sellers on Marketplaces

Validate PAN, GSTIN, and company details in real-time for quick seller onboarding while ensuring compliance.

eSign in Seconds

Enable Aadhaar OTP or biometric eSign for instant contracts, speeding financial and legal agreements.

IP & Geo-Location Validation

Detect location-IP mismatches instantly via geo-fencing APIs to block fraud.

End-to-End Digital Verification

Rental & Property Management

Verify tenant identity and extract lease data via OCR for faster onboarding and checks.

KYC Compliance for Telecom Operators

Verify Aadhaar or Voter ID via OTP/biometrics to meet telecom KYC norms and prevent fraud.

Insurance Policy Issuance & Claims

Digitally verify customer identity and documents to speed policy issuance and prevent fraud.

Integrated Solutions for Financial Operations

Credit Risk Assessment

Automatically evaluate creditworthiness before high-value transactions or extended payment terms.

Optimize Accounts Receivable

Optimize collections and minimize bad debts by matching strategies to customer credit profiles.

Smarter Lending & Financing Decisions

Access credit reports during loan processing to ensure low defaults and compliance.

Future-Ready APIs for the Financial Ecosystem

Unlock seamless integrations, real-time data, and scalable infrastructure — purpose-built for banks, NBFCs, fintechs, and enterprise platforms.

One Unified API for all BFSI products and services

Widest coverage across banks, NBFCs, and FIs

Modular architecture tailored to your needs

Real-time data exchange across all financial workflows

Single point of contact from onboarding to go-live

Enterprise-grade security and compliance

Fast, flexible implementation for every business type

Zero-downtime deployment with expert assistance

Dedicated developer support for fast troubleshooting

Clear documentation and sandbox environments

Rapid deployment and easy integration workflows

SDKs and code samples for faster prototyping

End-to-End Credit Intelligence for Safer Business Decisions

Banks and financial institutions use tailored insurance to protect assets, ensure stability, and guard against risks like errors, cyber threats, and fraud, while maintaining compliance in a changing landscape.

Insurance providers rely on trusted verification to process claims accurately, validate policies, prevent fraud, and maintain regulatory compliance, safeguarding customers and ensuring trust.

Accelerate investor onboarding with fast, secure, and fully compliant verification, reducing friction, preventing fraud, ensuring regulatory adherence, and delivering a seamless experience that builds long-term trust and strengthens investor relationshi

Streamline customer onboarding with fast, secure digital verification, reducing friction and enhancing user experience, while ensuring real-time fraud protection, regulatory compliance, and building long-term trust.

Accelerate investor onboarding with fast, secure verification, ensuring full compliance, seamless user experience, and robust fraud prevention, while building long-term trust, strengthening investor confidence, and enabling efficient, scalable financial operations.

Got Questions? We’ve Got Answers.

What is Veriqos and who is it for?

We offer APIs and tools for identity verification, compliance, fraud prevention, financial assessment, and onboarding automation.

How fast are the verification results?

Most of our APIs return results in real time, typically under 2 seconds. Our infrastructure is optimized for speed, scalability, and low-latency performance.

Is Veriqos compliant with Indian and global regulations?

Yes. We’re built to support compliance for financial institutions, regulated entities, and businesses requiring stringent onboarding checks.

What integrations do you offer?

We offer REST APIs, SDKs, and sandbox environments to easily integrate our services into your mobile app, web platform, or internal tools. Our APIs are language-agnostic and developer-friendly.

Need help with something? Want a demo? Get in touch with our friendly team and we’ll get in touch within 2 hours.

Our verified agencies are trusted by top brands

Our representative will reach out to assist you further.

Our representative will reach out to assist you further.